So this came in mail….ALREADY! It’s time to make my first annual tax payment for my newfound LLC, that I had just formed over the spring. Where did the time go?

This is one of the less fun parts of this starting a new business journey that I am embarking in, but nonetheless, inevitable. And all this is totally unfamiliar territory for me. Feel free to correct me if any of my understanding is wrong in this post, as I am still learning everything as I go. This is where all the overwhelming feels start kicking in. Shit starts to get real. All that fun and excitement of planning, baking fun in the kitchen, taste testing new recipes becomes met with the realities of the less exciting inevitables that I know pretty much nothing about.

Luckily, there are helpful videos like the one below to help even the most clueless new business owner (like me) understand all this annual tax nonsense a little better.

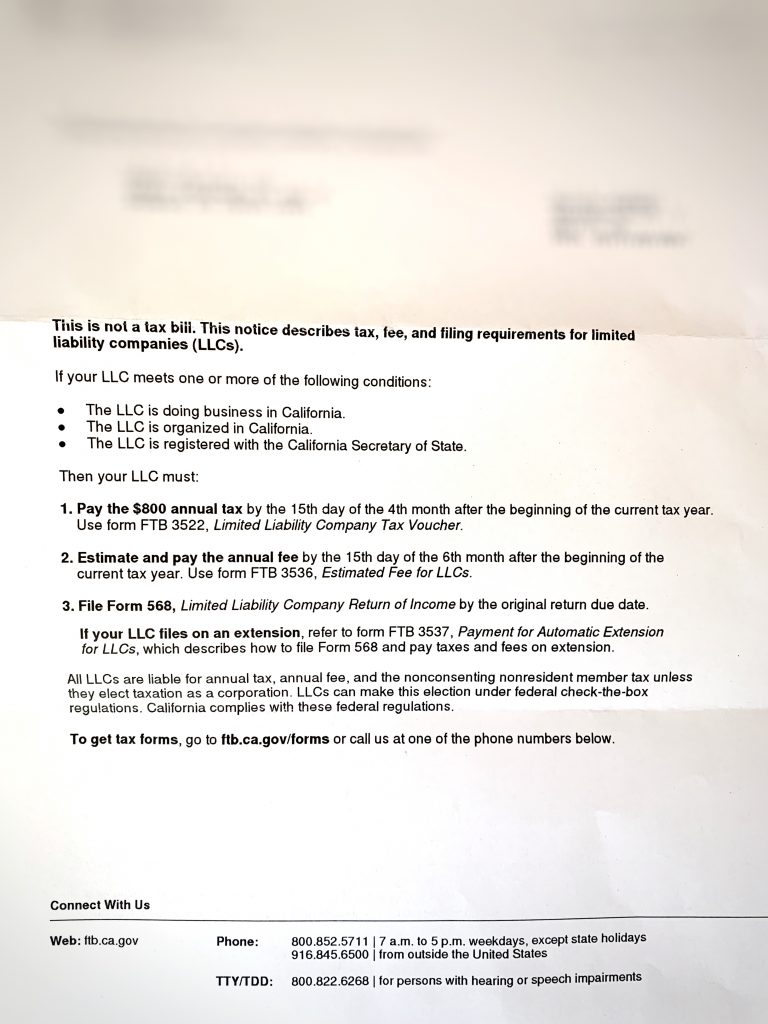

- Annual LLC Franchise Tax of $800 annual tax is due by the 15th day of the fourth month after the beginning of the current tax year. FTB 3522, Limited Liability Company Tax Voucher. After the first payment, annual due date is on the 15th of April of each year.

Apparently, the month that you had filed for the LLC counts as the first month despite when in the month you filed (the 1st, 30th, 15th…..makes no difference what date). Since I filed for mine in May and it is now August, I guess we are already at that time….the dreaded moment! And I haven’t even begun to sell. I’m still waiting for approval by the health department and who knows how long that’s going to take?! I was told that getting approved typically takes anywhere from two to six weeks. It’s been a few weeks now. So I file the FTB 3522 in August of this year, and then again on the 15th of April each year after.

- Estimate and pay the annual fee by the 15th day of the sixth month after the beginning of the current tax year. FTB 3536 . After the first payment, the payment is due on the 15th of June.

So my month to pay for this one would be on the 15th of October. However, as a new business, I want to keep goals realistic. The FTB 3536 is an additional fee only if your LLC makes $250,000 or more for the tax year. I’m pretty sure I’ll be safe from this one in the beginning, for a while, as it takes time and endless hard work to grow any business.

- File Form 568, due on the 15th day of the fourth month after the end of the taxable year. For most, it would be the 15th of April (if tax year is from January to December).

Form 568 is like a summary of the LLC’s financial activity during the given tax year.

- Report the Estimated Fee for the LLC

- Report the $800 Annual Franchise Tax

- Report and pay taxes for any members who are not CA residents

This is another one I need to pay up, regardless of income! Form 568 pays taxes on the previous year’s income. And oh my goodness, to help me sort through this one, I’m definitely going to need an accountant (as recommended), as it can get confusing. It’s freaking seven pages long!

Everything in this post are notes that I have jotted down from what I have learned as I’ve been doing my research. The purpose of the post is to use as my own reference along the way. It helps me keep track of things. By sharing, I hope that it can also be of reference to others.